By: Sam Kinsman

“It’s the economy, stupid”

Both candidates have made it abundantly clear in their speeches that their campaigns are focused on th

e economy. In fact, nearly every answer the candidates have given during recent debates reverts back to their plan to turnaround the lackluster economic growth, high unemployment, and uncertain economic future facing the country. Topics ranging from women’s equality in the workplace to immigration to healthcare to foreign policy all lead the candidates back to their core economic platform (and a discussion about taxes). With all the focus on the U.S. economy, taxes, and economic growth, it is worth taking a look at what the new president will deal with on his first day in office with respect to the economy. The United States economy grew at an anemic rate of 1.7% in 2011, and is expected to grow only 1.9% this year and 2.4% in 2013. This is, of course, until we hit the Fiscal Cliff.

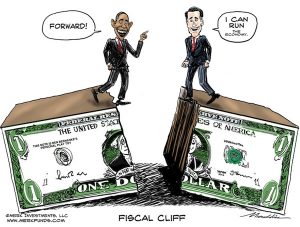

The Cliff

The “Fiscal Cliff” is the term markets have adopted to describe the massive economic impact of spending increases and automatic tax cuts that are set to take place at start of next year. In short, previously passed legislation including the Tax, Unemployment Insurance Reauthorization, and Job Creation Act of 2010 and the Budget Control Act of 2011 will come into effect at the start of the year and the fiscal impact of these bills threatens to throw the U.S. economy back into a recession. As discussed above, the economy is growing at a rate of less than 2.0% this year and is not expected to do much better in the near future. Changes in tax policy that will increase taxes and automatic spending cuts that will reduce the government’s contribution to domestic output are expected to drop GDP by 5.1% comfortably back into recession and send unemployment back above 9%.

Changes in tax policy

Fiscal Impact: $630 billion (3.4% of GDP)

Tax cuts made from 2001 to 2003 will expire at the end of the year. The result of this expiration will include an increase in the highest marginal individual tax rate (to 39%), an expansion of the alternative minimum tax, and higher estate, capital gains, and dividend taxes (which reduce returns on investments). The changes will also include an increase in current payroll taxes (to 6.2% from 4.2%), new healthcare taxes to support the Affordable Care Act, and an expiration of research tax credits. Taken together, these policies that reduce employee’s take home pay, increase their annual taxes, and decrease returns on investment will take money out of the hands of people to spend it in the economy (to the tune of $630 billion dollars).

Automatic reductions in spending

Fiscal Impact: $276 billion (1.7% of GDP)

The effects of the summer 2011 budget showdown in congress will finally arrive at the start of the year with automatic spending cuts set to take place that will impact another 1.7% of U.S. GDP. Military and other spending will reduce, Medicare payments will decrease, and the extension for unemployment insurance for millions of Americans without work will be expire. The lower spending will decrease the government’s contribution to Gross Domestic Product.

Moving Forward

The first day on the job as president will be a tough one for either candidate elected. After the hearing the famous lines, “Mr. President, here is your intelligence,” he will be handed a full platter of domestic and foreign policy issues waiting for attention from the new leader. The fact remains that unless a lame duck Congress is able to come to agreement before the end of the year, the U.S. economy will leap from the cliff into a scary free fall that will only discourage people from spending, employers from hiring, and businesses and entrepreneurs from taking on risk to innovate and find the next big ideas. The smart president will turn this base jump into a bungee line that will snap us back up into the steady progress towards economic recovery or in their campaign words, “a more bright and prosperous future.”