By Gaby Lohner

Earlier this month , the International Consortium of Investigative Journalists leaked information from a series of documents that have been dubbed the Panama Papers. These papers, exceeding more than 11 million documents, have created a ripple in the world of international finance. The name comes from the home of the documents, the Panamanian law firm Mossack Fonseca, which has been helping high-ranking government officials and businessmen hold offshore accounts for 40 years. This leak has provided the general populace with some insight into how the world’s 1 percent are making and storing their money, and most people are not too pleased about it.

Offshoring

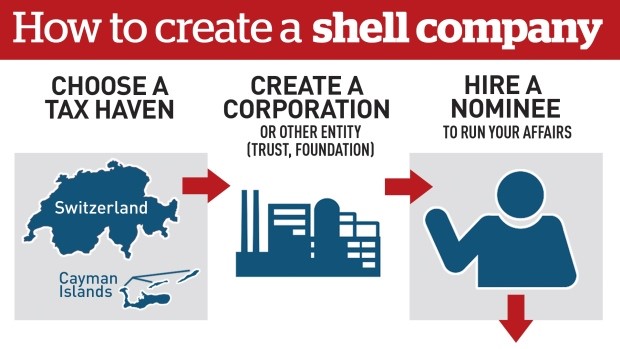

Offshoring is the process of moving business operations from one country to another. Typically it is associated with business relocating production of a good to a country where labor and manufacturing are cheap (think: Nike making shoes in Vietnam). Offshoring can also be used for financial accounts as a way to circumvent taxes, which is the focus of this leak. Shell companies are another tool to avoid paying taxes. A shell company doesn’t engage in normal business operations, but is rather more of an intermediary for investments. They aren’t illegal when used for normal purposes, but many people abuse this business structure to hold money as a tax evasion tool.

These practices are controversial when used legally, so they are hated when abused. Evaded taxes could be used on schools, roads, and other social programs to help the countries where these people reside and participate in society. This anger is the reason that those who partake use a secure, secretive company to manage their holdings – one like Mossack Fonseca claimed to be. That is, until an anonymous source sent the documents to a German newspaper called Suddeutsche Zeitung in 2015, who then shared them with the ICIJ. After a year of reading through the documents, the group shared the most important points earlier this month.

The Leak

The 11.5 million financial and legal records that have been released by the ICIJ contain a slew of incriminating evidence against some very important people. Leaders of countries such as Argentina, Russia, Iceland, and Britain are all under fire for their involvement, whether directly or through family members. The documents name 12 current or former world leaders and 128 politicians and public figures associated with these offshore accounts. They also show that Mossack Fonseca knows only 204 owners of the 14,086 companies that work with the law firm, exposing a gross lack of transparency within the company. While the actual data, along with the physical documents, have not been released by the ICIJ, the estimates of how much money is being held offshore is staggering – the Tax Justice Network estimated in 2010 that the total was anywhere from $21 to $32 trillion, and it has likely only grown since then. This is an astonishing 8 to 13 percent of total global wealth. This practice has created a vast reduction in the money provided to developing nations, an estimated $1 trillion of unreceived tax revenue.

Who did it?

Who released the papers is still unknown. Clifford Gaddy, an economist with the Brookings Institute, wrote a blog post on Thursday asserting that Russia has leaked the documents, based on the country’s hacking skills and Putin’s desire to discredit the West. Gaddy believes that Putin wants to cover his own corruption by saying, “Look, everyone does it.” One of the selling points of this theory is that nothing new was released about Putin, despite rumors of a huge fortune hidden somewhere. While Putin isn’t mentioned, a few of his friends are accredited with $2 billion in offshore assets. Gaddy describes this as “the dog that didn’t bark.” While this theory hasn’t received too much acknowledgement, it seems that nothing can be taken off of the table yet.

All that is known about the hacker is that he or she didn’t have to work very hard in order to infiltrate Mossack Fonseca’s records. The website the company used is known to have security concerns that any average computer-whiz could break. The password hasn’t been changed in three years, something that is supposed to happen every thirty days. For a company that has so much on the line, they did a poor job of protecting themselves against an attack like this.

Consequences?

Some countries are immediately punishing those involved — such as Iceland, whose Prime Minister resigned amidst the controversy — while others are taking the time to investigate those mentioned in the reports. British Prime Minister David Cameron is linked to the law firm through holdings in the name of his late father, an account that Cameron inherited. Cameron is attempting to clear his name, having released his tax returns from the past six years and claiming he has paid taxes on the inheritance. The public is not convinced, though, nor are they happy – Cameron once reprimanded Brits who set up offshore accounts for tax purposes.

For some countries, the consequences are more drastic. Rather than just focusing on the individuals involved, smaller countries are also dealing with the implications of the tax revenue the governments are shorted. While the UK and the like will continue to be economic powerhouses without the taxes collected from these individuals, other countries would benefit greatly from this income. Alison Holder, an employee at Oxfam, says that tax avoidance (which is the legal version of tax evasion) “has very direct life or death impacts in poorer countries,” and studies estimate tax evasions led to the deaths of 5.6 million children from 2000 to 2015. The implications of these actions are great in developing nations – we can brush off the practice, to an extent, in the United States, but it is much more serious abroad. The G20 countries are aware of this problem and are working together towards global tax reform, but there have not been any big developments in the policy.

For Mossack Fonseca, intense international scrutiny will certainly ensue. Last week, officials began raids of the company’s offices in Lima and Panama City, searching for illegal activity that will confirm the reports. The owners of the company claim they have done no wrong .

The Panama Papers will have the lasting impact of exposing the corruption that exists within the global financial system. As a resident of a developed, democratic country, it is easy to brush off corruption as something that happens in unstable, unregulated countries, but these reports show that malpractice is happening close to home. And it isn’t just shady businessmen who are trying to get around the system, it is the people leading our countries and deciding how taxpayer money is spent. No longer can Americans, Brits, Icelanders and citizens of other developed nations turn a blind eye to these practices. Before, we took comfort in the ideals of “out of sight, out of mind,” but the issues are no longer out of sight. The questions this leak raises are big ones: How many other world leaders, businessmen, and officials hold offshore accounts like the ones managed by Mossack Fonseca? What happens to the accused? How do we confirm the morality of current and future leaders? The information from the Panama Papers has led to a worldwide skepticism about the nature of global investments, and the concern certainly won’t be going anywhere soon.