By: Chris Neill

Ben Bernanke devoted his academic career to studying the Great Depression. After standing at the helm of the United States economy in its darkest hour since the Depression, Bernanke may be the happiest of all in the search for his successor as Chairman of the Federal Reserve when his term ends in January. Everyone else, however, is still grueling through the contentious process with no end in sight. Lawrence Summers, widely considered an early favorite given his close connection and past work with President Barack Obama, withdrew his name from consideration after fierce opposition from economists and lawmakers alike. Now Janet Yellen occupies the nominal frontrunner position with ample public support, but President Obama has yet to make a decision.

Summers is no stranger to the forefront of U.S. economic policy; during the Clinton administration, he served as Secretary of the Treasury. It was this position that damaged his reputation among so many. During this time, Summers led the push to overturn the Depression-era Glass-Steagall Act, which built a figurative regulatory wall between commercial banks and investment banks to protect the stability and safety of customer deposits in commercial financial institutions. He also resisted the regulation of derivative instruments. His propensity for financial deregulation, particularly in areas which played a role in the 2008 financial crisis, did not sit well with many lawmakers. Senators Jon Tester, Jeff Merkley and Sherrod Brown publicly stated they would oppose his nomination. These statements all but killed Summers’ chances given that all three are Democratic members of the Senate Banking Committee and support from Republicans on the committee is unlikely.

In a statement released after Summers’ withdrawal, Obama expressed gratitude toward Summers for his advice and counsel during the financial crisis and implied that he had no intention of burning that bridge of advice and counsel in the near future. Despite his quick response to the downfall of his preferred candidate, Obama has yet to speak further on the subject or acknowledge any new potential candidates.

When Obama remained silent, though, a loud chorus of economists and lawmakers have spoken and endorsed Janet Yellen, the current Vice Chair of the Federal Reserve. Yellen would be a historic pick, as the first woman to hold the top position at the Federal Reserve. Several Democratic Senators publicly endorsed Yellen in a letter to Obama. They highlight her experience in academia, advisory and bank regulation, and praise her knowledge of monetary policy. Specifically, they express appreciation for her understanding of monetary policy as a tool to combat unemployment.

Shelia Bair, former Chair of the Federal Deposit Insurance Corp., also expressed cautious support for Yellen. Bair acknowledges that Yellen also supported the repeal of Glass-Steagall in the ’90s, but stipulated that this alone doesn’t make her less qualified than any other potential candidate. Yellen’s position on the Act “really didn’t surprise me,” said Bair. “Everybody at the Fed [supported the repeal]. But I think she’s the best of the people out there.”

Yellen, like Bair, also warned about the dangers of the growing housing bubble and predatory lending practices that became widespread during the early and mid-2000’s. Where many regulators downplayed these issues, Yellen claimed they represented critical flaws in the U.S. financial system. “The possibilities of a credit crunch developing and of the economy slipping into recession seem all too real,” Yellen said to fellow Federal Reserve officials in December 2007. She expressed concern over the dangers inherent in the shadow banking system and increasingly complex credit markets. John Williams, one of Yellen’s subordinates in her time at the San Fransisco Federal Reserve, observed that she was “very much a person who asks very probing questions, wants to understand kind of what’s below the conclusions.”

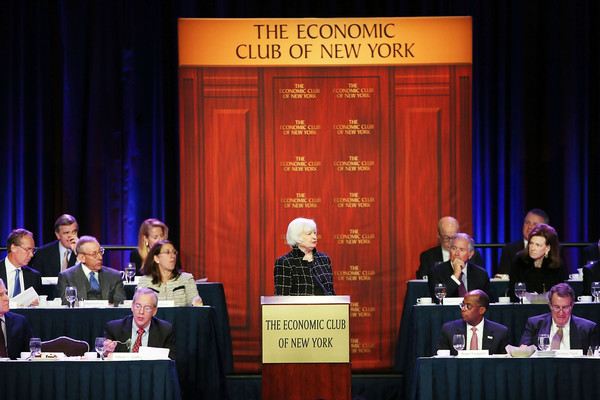

As the Senators noted in their letter to Obama, Yellen focuses much of her work on the topic of unemployment. As an academic, she studied how the labor market operates and why it works differently from other markets – particularly in times of recession. In a March 2013 speech, Yellen said she believed that increasing employment should “take center stage in the conduct of monetary policy.” She argued that a low federal funds rate (one of the most important benchmark interest rates) is crucial for making the economy more “accommodative” to boosting employment. Likewise, she voiced support for the Federal Reserve’s ongoing asset purchases linked to “substantial improvement in the outlook for the labor market.” She noted the importance of watching not only current conditions in the labor market but the outlook for future conditions in the labor market as a signal to tighten monetary policy.

Yellen concluded this speech by definitively stating her position that the Federal Reserve should continue to actively use its tools to create an accommodative monetary policy that would support a rapid growth in employment. While the Democratic authors of the letter certainly approve of her more dovish positions on monetary policy, their issue with Summers may not be their disapproval of any public statements of his positions but the difficulty one might have in finding any. The Economist observes that Summers “has sat out the day’s heated monetary debates—save for a mildly skeptical take on QE in remarks at an April conference.” In contrast, they say that Yellen’s positions are an “open book,” citing her willingness to write and speak about her positions.

Less than a month prior, Democrats pushed back against Obama’s proposed air strike in Syria. Now, whether motivated by a true affinity for Yellen, a distrust of Summers or just a lack of knowledge on his stances, a group of Democratic Senators effectively killed the nomination hopes of Obama’s preferred nominee for Federal Reserve Chairman. Now that Congressional Democrats’ growing divergence from their own party’s President has manifested in this debate, the nomination for the next Chairman of the Federal Reserve seems all but certain. Unless a dark horse candidate such as former Federal Reserve Vice-Chairmen Donald Kohn or Robert Ferguson, or former Treasury Secretary Timothy Geithner, makes huge strides toward the forefront, Janet Yellen seems to be on deck to replace Ben Bernanke and continue his efforts to stimulate growth and combat unemployment.