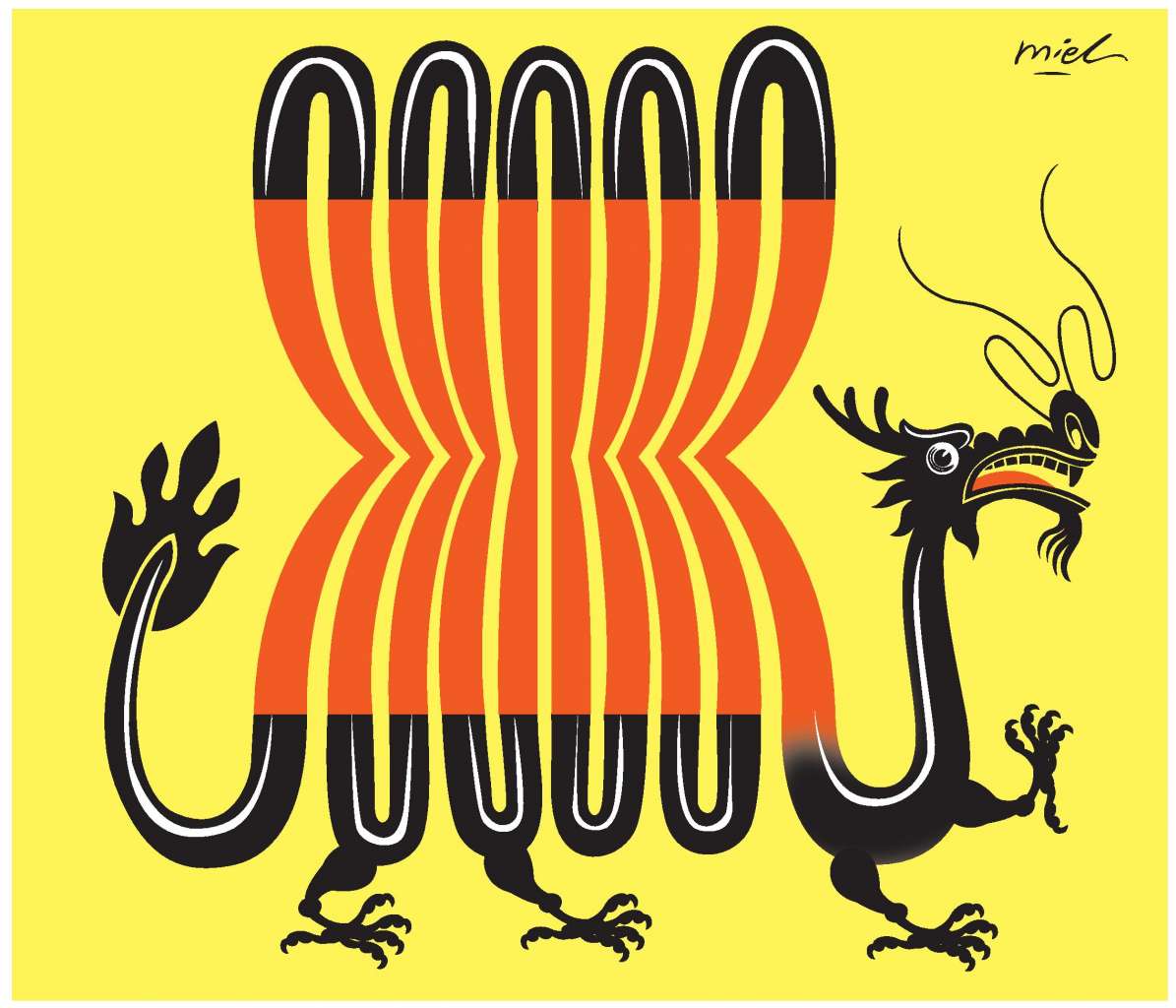

Over the past few months, the world has watched as Hong Kong experienced unprecedented civil unrest. The protests, coordinated by student groups throughout the city, have one aim: to broaden the scope of the democratic process in coming elections. Currently, Hong Kong operates under the “basic law,” a de facto constitution put in place during the handover of control of the region in 1997 from Great Britain to China. “Basic Law” states, Hong Kong will co-exist with China as one country with two distinct political systems for 50 years.

During this time Hong Kong enjoys the liberties of an independent judicial system and free media. However since the handover, the region’s leader has been elected by a 1,200-person board of Beijing elite, which is where the bulk of the problem lies. Citizens of Hong Kong are now asking to break with tradition and democratically elect their own leader in the 2017 election.

In August, when the Chinese government announced that all candidates would need to be pre-approved by a committee friendly to the Chinese Communist Party, student groups began mobilizing to reject the authority of mainland China. What is being overlooked, however, is the core root of this unrest and push for democracy. Hong Kong in recent years has seen economic conditions erode and inequality increase, which are two primers for social unrest.

Hong Kong is a small and highly open economy making it attractive to international enterprises but also highly sensitive to global economic developments. Since 2008 limited housing supply, low mortgage rates, strong GDP growth, and heavy international demand have increased property prices in Hong Kong by 135 percent, making the city the second most expensive in the world following London. This upturn in cost of living has not been matched by accompanying wage growth, especially for the lower and middle classes. This all results in Hong Kong’s real income inequality, measured by the Gini index, being worse than that of Mexico. Who might be impacted the most by increased income inequality and declining economic conditions? Students are a good guess. After all, students do have very little disposable income.

Many times, “Occupy Central” has been likened to Tiananmen Square; however, when you examine the underlying cause of the movement, “Occupy Central” begins to look a lot more like “Occupy Wall Street.” Both movements reflect youth dissatisfaction with income polarization, diminishing advancement opportunities, and an inability to earn a living wage in a city where external forces drive the cost of everything, from an apartment to a sandwich to tuition, through the roof.

In this context, China begins to looks more like the scapegoat than the instigator. Hong Kong thrives on its open economy relative to the surrounding region. By providing access to the Chinese economy on a capitalist platform, they have served as Eastern intermediaries to the Western world. However, as China continues to open their economic doors, any sort of heightened regulation in Hong Kong, whether political or economic, is received negatively. They must stay ahead of the democratic curve to maintain their competitive advantage.

Going forward, contrary to popular protest aims, it is in Hong Kong’s best interest to form collaborative progressive social and economic policy that is closely tied to China, not separated from it. Although counter-intuitive, their relationship is too intertwined to sever. China is Hong Kong’s largest export partner with 58 percent of net exports, as well as their largest import partner at 45 percent of net imports. Of funds invested directly into Hong Kong from abroad, 75 percent come from China, and 75 percent of visitors to Hong Kong each year come from mainland China.

Long story short, Hong Kong needs China. Even more worrisome to Hong Kong’s future is the rapid shift in geographic capital allocation within the Chinese–Hong Kong economy. In 2012, funds flowing in from foreign countries decreased by 20 percent in Hong Kong while they increased by 20 percent in Shanghai. This change reflects a growing international attitude that Hong Kong might no longer be the Chinese gatekeepers. Because of China’s increasingly accommodating globalized economy, foreign investors go straight to the growing economies; there is no need to go through Hong Kong as the middle man.

So what does this mean for Hong Kong going forward? Luckily, all hope is far from lost. Leaders of Hong Kong and in Beijing must work collaboratively to reintegrate Hong Kong into the Chinese economy. They must work to repair the eroding social fabric of Hong Kong culture by closing the expanding income gap, and, most importantly, they must work for political liberties for citizens of Hong Kong while maintaining close ties with China. Both of their economic lives depend on it.