The stories are familiar. The international affairs major working at Jittery Joes. The philosophy major waiting tables at Steak ‘n Shake. The chemistry major bagging groceries at Kroger. For recent graduates, the job market is bleak.

Unemployment rates are higher for recent graduates than they have been in the last 10 years and are higher than unemployment rates for any other group of adults. According to the Associated Press, more than half of recent college graduates (53.6 percent) in America are either unemployed or working in a job that doesn’t require their particular bachelor’s degree. According to the New York Times, these statistics are significantly higher for humanities majors than for math or computer science majors, with 4 percent higher unemployment and 19 percent higher employment in jobs that do not require a college degree.

There are those who are lucky enough to have found a job. But they’re rare. Only 56 percent of the class of 2010 had found a job by the spring of 2011. However, employment has not solved all of their problems. The median starting salary for recent graduates has decreased by 10 percent since 2008. Today, the average starting salary for a recent graduate is $27,000.

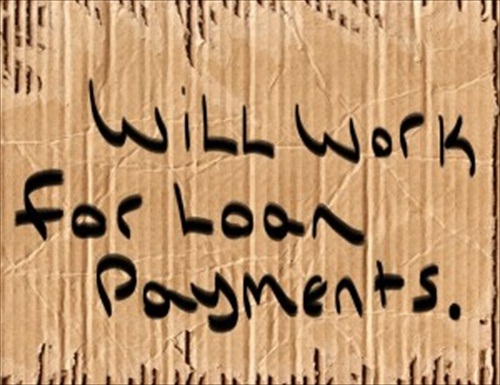

To finance their education – which is dropping in value – two-thirds of all college students take out student loans. At the same time, the cost of attaining a degree has risen each year. Over the past three decades, the cost of college has nearly tripled. Today, the average student leaves college with $26,500 in debt. The University of Georgia is no exception; in 2010, the average student graduated with $15,938 in debt, and tuition has continued to rise exponentially.

Between lower values of college degrees, higher cost of tuition, lower rates of unemployment, and lower starting salaries, members of Generation Y are facing tremendous hurdles in making the transition from student to adult.

Our generation was taught from a young age that a college degree was vital to success. We took that advice. Our generation worked hard in high school and was accepted into college. Now, four years later, graduates are being handed their diplomas, getting in their parents’ minivans, and moving back home.

Something went wrong.

Our generation’s inability to find a job is throwing a wrench not only into our own plans, but also our parents’. Saddled with massive amounts of debt from the rising costs of education, yet unable to find a job in the difficult job market, recent graduates are left with debt and without savings. It kills the momentum within our lives, because until we have secure finances, we can’t grow up, get married, buy a house, or have children. Meanwhile, our parents are burdened with the unexpected costs of supporting their adult children. We’re pushing back their retirement, draining their savings, and causing them unnecessary stress and worry.

So why hasn’t more been done to address this problem?

President Obama recently announced a new program to make higher education more affordable by helping current students consolidate their loans and make lower monthly payments. While that will help students who take out loans in the future, it leaves those who are currently stranded in the job market high and dry.

Meanwhile, universities such as The University of Georgia continued to produce over 2,000 degrees in the arts and the humanities each year while raising the price of tuition.

We current students should be worried, but all too often, we’re not – or at least, not until we’re seniors.

Be proactive. Don’t ignore these numbers. Take the time to utilize the resources provided by the university. Go to the Career Counseling Center. Take advantage of internship credit within your majors. Pursue a double major or a minor in with tangible and marketable skills. Network and take advantage of the powerful and successful alumni from this university.

Don’t become a part of these statistics.